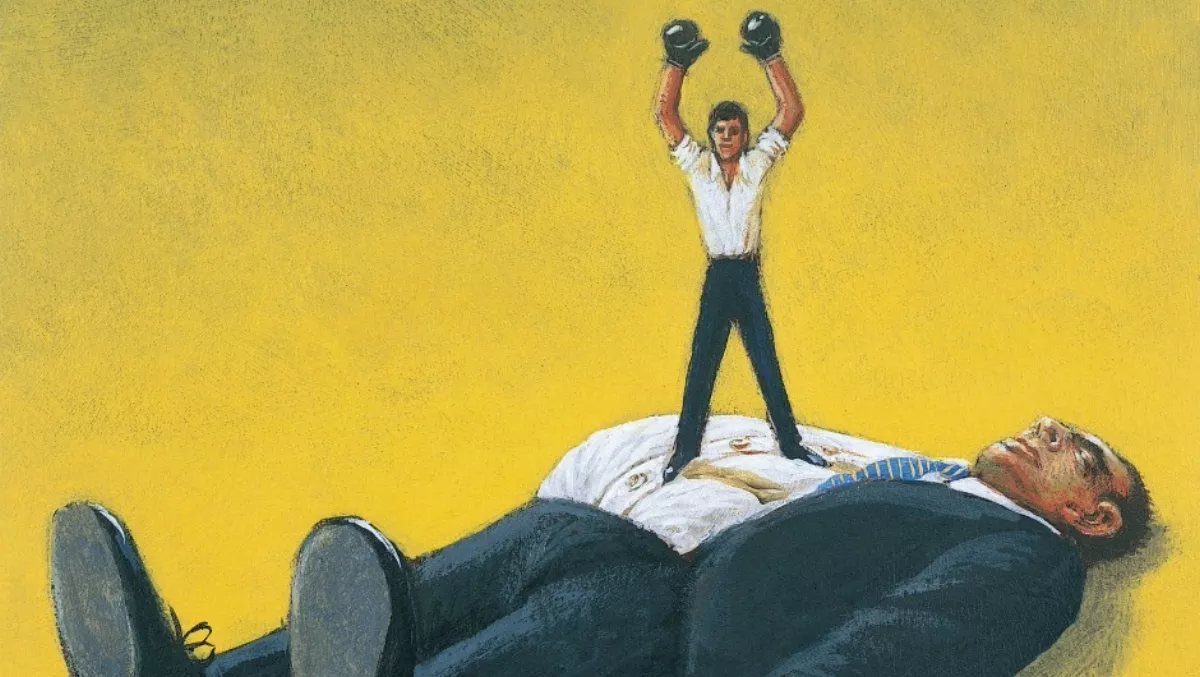

How cloud technology is helping SMBs take on giants of their industry

At last, the argument of whether a small business should or shouldn't be operating in the cloud has been put to bed. The cloud has won.

Running a business these days almost hinges on cloud computing. According to the annual Vanson Bourne cloud computing study, some 78% of UK organisations have already adopted at least one cloud-based service.

Everytime you update your Facebook status, Tweet an article or check your bank balance online you're pulling data from the cloud.

Deciding to adopt cloud technology has helped small businesses, right around the world, transform into more agile entities with the ability to take on giants in their sector.

Moving to cloud is helping small businesses act like giants

Size no longer matters. Many tech advances which were once available only to big businesses are now ubiquitous. That means small businesses are better equipped than ever to compete with multinational powerhouses in their sector.

PR agency, firstlight, is one small UK business which has used its size as an advantage to help it compete with some of the largest firms in its field.

"I thought our size was our weakness," recalls firstlight founder, Paul Davies. "But I soon realised it was our strength." That realisation gave him the confidence to take on big agencies head on, vying for the biggest brands… and winning.

He remembers one momentous land grab: "We beat some of the biggest agencies in the world for a global retail business – which was amazing for a small business. We were invited to the shortlist, no-one knew who we were… and we won the business." After a major scalp as a start-up agency, they went on to add LinkedIn as another household name on an increasingly prestigious client list.

Despite growing turnover and an enviable client list, Davies knows lean businesses mean business.

And although his days as a jack of all trades – fulfilling bookkeeping, IT support and day-to-day management – are over, Davies still wants to keep his team agile and efficient. Xero helps him to do just that. When Davies hired a Financial Director, Xero allowed him to make that role part time, just one day a week. Without Xero, Davies estimates that would increase to three days. It's a small but meaningful difference.

Small businesses now have a grip on what's going on, before it happens

For other small businesses, cloud technology helps them better forecast peaks and troughs and plan accordingly.

For Darren Rook, Founder of The London Distillery Company, his busy period is September – that's when his Christmas rush begins. Crafting fine London gin in time for the festive season means he needs a robust inventory system to help keep an eye on stock and invoices and manage his cashflow.

"After some trial and error on different software platforms we settled on Xero. It's simple interface and range of useful tools helped us plan for all the extra costs at Christmas including extra bottles, storage space and base ingredients," Rook said.

"The problem with running a distillery is managing stockist expectations. Fortnum - Mason's, for example, want their Christmas stock delivered in September, so we have to work months ahead of Christmas to be ready for the trade orders. We use the financial control system on Xero as it's perfect for collecting, storing, analysing and monitoring stock figures.

Having all this data available enables Rook to plan for the slow periods and ramp up for the busy times.

Big company resources for small businesses

Being a small business means you usually have limited resources. You don't usually have a full security, HR, sales, finance or PR team. Usually the owner plays each of those roles, either all at once or switches between them throughout their day.

All this juggling means many small business owners spread themselves wide but not deep. However, cloud technology is helping fill those gaps by enabling small business owners to implement some muscle in spots they may not be able to tend to.

Take security, for many small businesses protecting data can often slip down the priority ladder. It's not that it's not important, it's usually a resource issue – owners usually focus their energies on hitting primary business goals. However, for cloud platforms keeping data safe and secure is a business critical task. This means but implementing a cloud solution for web hosting, storage, data backup or even email, many small businesses benefit from big business grade tech, without the huge outlay.

As a financial platform, Xero is making many little, yet significant, impacts across the business; from allowing employees to track expenses easily, to cutting down report production to a few clicks, and billing effortlessly through an accounts receivable email address – it all adds up.

Davies mulls over the biggest benefits of Xero: "Cost and time. In that order. If we didn't have Xero we'd have to pay someone to do everything manually. That would have cost us a lot of money over six years and would have stopped us doing what we do best – working hard for our clients.