Global payments solution Stripe says 'kia ora' as it launches in NZ

Mobile payments solution Stripe has today announced its official launch in New Zealand.

Businesses in New Zealand can now sign up instantly and start accepting payments in minutes with more than 135 currencies from customers around the world.

Feedback from thousands of companies helped shape its product for New Zealand.

During the preview, Stripe worked with some of the region's fastest-growing businesses: Xero uses Stripe to let any of their million users accept credit cards for their invoices—one of the first accounting platforms to do so.

Mobi2Go, a software-as-a-service platform for restaurants across the world, used Stripe to allow restaurants to accept payments from their customers with Apple Pay and cards in local currencies.

The company is holding Office Hours this Wednesday across four technology hubs in Auckland and Wellington for businesses considering Stripe to ask them questions about the solution.

The Wellington sessions will be at CreativeHQ Wellington and BizDojo Wellington, whereas the Auckland sessions will be at Icehouse Auckland and BizDojo Auckland.

"We can't wait to see what Kiwi companies build with Stripe," says Mac Wang, Stripe head of growth for Australia and New Zealand.

Stripe was born out of its founders experiencing first-hand the difficulty of accepting online payments.

On almost every front, it was becoming easier to build and launch an online business.

Payments, however, remained dominated by clunky legacy players.

It seemed clear to them that there should be a developer-focused, instant-setup payment platform that would scale to any size, and Stripe launched in September 2011.

Stripe now processes billions of dollars a year for thousands of businesses, from newly-launched start-ups to Fortune 500 companies.

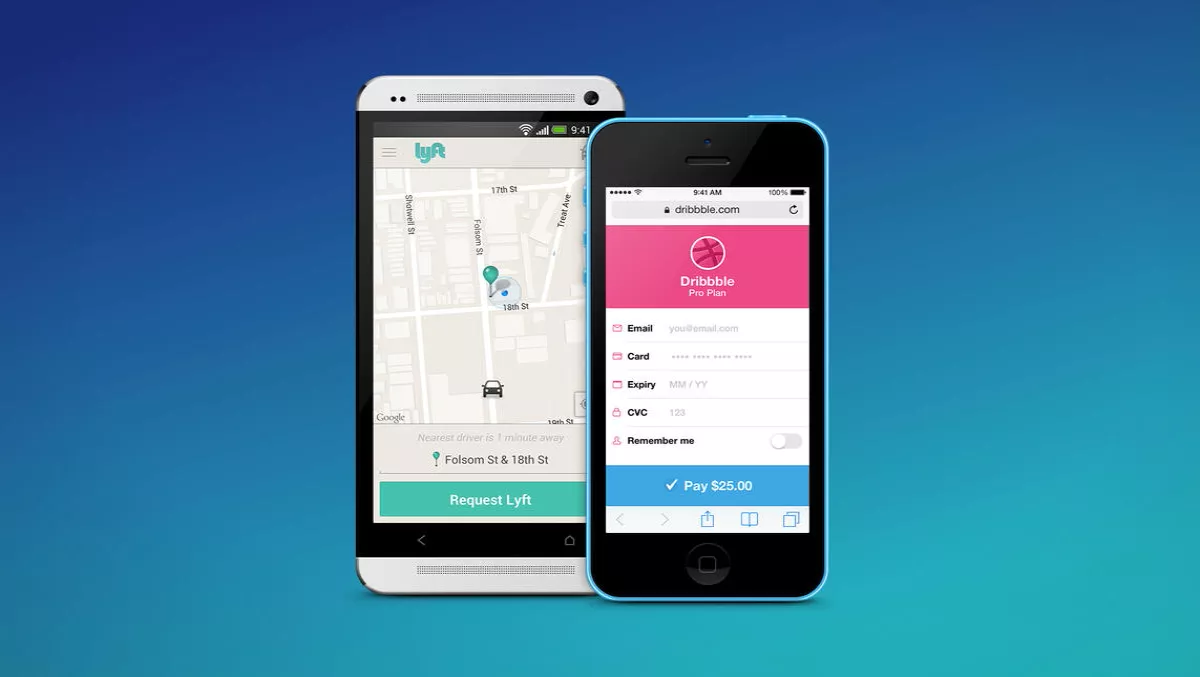

Web and mobile businesses around the world using Stripe including Twitter, Kickstarter, Shopify, Salesforce, Lyft.

Stripe is headquartered in San Francisco.

The company has received around US$450 million in funding to date; investors include Sequoia Capital, Visa, American Express, Peter Thiel, and Elon Musk.