What happens when the global banking system ‘goes down’?

Prussian diplomat Klemens Wenzel Furst von Metternich is famous for saying, "When America sneezes, the world catches a cold…" In other words, when confidence in the US and its economic stability worsens, other economies (and assets like Gold, silver and shares) tend to decrease in value. Like any other asset class, crypto is intrinsically linked to world events - but often behaves in the complete opposite manner…

A real-life episode of Black Mirror?

"What happens when the global banking system 'goes down'?" It's a question that usually has the anti-crypto crowd accusing those of asking the question of spreading dystopian views. Yet…this past weekend, in a real-life version of what might have felt a bit like 'Black Mirror' (a speculative fiction series set in the near-future dystopias of sci-fi technology), fiction became fact and banking - along with flight operations and hospital administration - 'went down'. A faulty update by a US cyber security firm disrupted 8.5 million Windows devices around the globe, and people literally couldn't pay for their meals, shopping or other critical services.

In very simplistic terms, this 'scare' caused many people (including the sceptics) to look at crypto through a brand new set of lenses. With their traditional means of transacting destabilised/unavailable, could crypto provide an alternative? The answer, of course, is YES. While banks and payment systems were down, those of us with stablecoins and other cryptos were able to transact freely, once again proving the strength and resilience of decentralised networks.

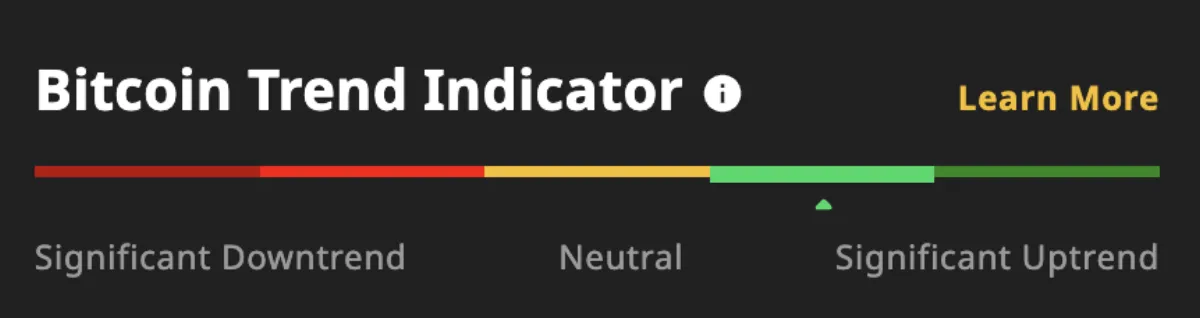

Throughout the weekend, Bitcoin's price reacted - quickly trending upwards - and by Monday, Coindesk had the strength and direction of trending behaviour in price at 'Significant uptrend' (below, 10:00 am Monday 22 July, 2024).

Single point of failure = big problem

For the first time, the logic of decentralised value exchange systems like Bitcoin and stablecoins jolted into reality for many.

It turns out that the banks and airlines were all using the same service provider (CrowdStrike), exponentially increasing risk through a single point of failure. This will only be exacerbated with the arrival of AI systems that are controlled by single entities but relied on by many.

Unlike banking, currencies like Bitcon and Ethereum avoid having a single point of failure because they have thousands of 'nodes' (computers that participate in the blockchain network). These nodes help ensure that no single entity can control the network, and they also provide massive resilience as many nodes can go offline, and the network can continue to perform without any material service disruption. By using the innovative technologies of blockchains and having a diverse and distributed network of nodes - the resilience, trustworthiness and integrity of crypto is now provably superior.

Resulting price volatility explained

Like other assets such as stocks, crypto trading is often driven by narratives and speculation, which can lead to price swings as traders react to news, rumours and market sentiment.

This is exactly what happened this weekend, but it's important to remember that these movements in price can often be as fickle as our daily headlines, and it is often hard to distinguish the exact event that triggered the market movements. What is clear is that Bitcoin benefited from both the Crowdstrike outage and the machinations of the US Presidential race. (As at the time of writing, Bitcoin was up 24% vs last two weeks, and up 8% since Friday.)

Sage advice for every investor

Crypto investment outside of stablecoins can be volatile, so knowing what you are getting into and having a solid strategy is key.

> Using the 'roller coaster' to your advantage

Rather than get 'hung up' on the rollercoaster that is crypto's daily price movements; smart investors are realising that they could benefit from actively exploiting it. When designing a balanced investment portfolio, investors will often look to achieve diversification through assets with low or negative correlation. This simply means that when one of their asset classes is performing well, another one might be flat or declining in value, and this helps balance overall risk. Given crypto's (often opposite) reaction to world events, it could help make a portfolio less volatile and can help reduce some of the inevitable ups and downs of market cycles as its ticker slides in the opposite direction.

> Stick to proven investment strategies

However tempting it is to make decisions based on sentiment, investors should anchor their strategies in time-tested approaches designed to weather market volatility:

Dollar cost averaging (DCA): Embrace the discipline of regularly investing fixed amounts, irrespective of market conditions. DCA mitigates the impact of short-term price fluctuations by averaging out costs over time and promoting a steady accumulation of assets.

The Hold-On-for-Dear-Life (HODL) strategy: In a market rife with volatility, the HODL mantra focuses on the importance of long-term conviction over short-term speculation. By focusing on the intrinsic value and fundamentals of assets rather than succumbing to market hysteria, investors can cultivate their resilience.

Diversification: Diversification remains a cornerstone of sound investment practice and sees investors spread investments across different assets (such as types of coins) to minimise risk from volatile market swings. A diversified portfolio fosters resilience and safeguards against unforeseen market turbulence.

The weekend's events underscored the fragility of our traditional financial systems and highlighted the potential of crypto as a resilient alternative that offers continuous transaction capabilities unaffected by centralised failures. It's important to remember, however, that resulting rapid price movements are often driven by speculation and short-term reactions to news. By staying both disciplined and informed, investors can turn the pricing' roller coaster' into a strategic advantage, ensuring their portfolios are well-positioned to weather any storm—financial or technological.